NOTE: AMEX Premier Gold (and Platinum) cards can NOT be downgraded to AMEX EveryDay card, because they are different products. One is a charge card, the other is a credit card.

I received my AMEX EveryDay card, because the AMEX customer support must be confused to say that the downgrade is do-able, but they ended up applying the AMEX EveryDay card for me. Luckily, I found out this when I was perplexed about why a new renewal of American Express Premier Gold Card would come, and called AMEX customer support about their "mistake". My AMEX Premier Gold card was not cancelled! Otherwise, I would be billed $195 in a month or two.

Why downgrading a premier credit card

- Keep the card history, valuable when a long one, which improves FICO score. American Express used to issue new AMEX card with the card open date to match your oldest active AMEX card, but it cancelled this practice since March of 2015. In my case, I have three AMEX cards with 11 years history each.

- Avoid expensive annual fee; select a no-fee card. Only AMEX EveryDay card fits this requirement regarding Membership Reward points.

- Keep the reward points non-expiring. Like Chase Ultimate Reward points, AMEX Membership Reward points will be forfeited if all AMEX Membership Reward-eligible cards are cancelled for the account. AMEX EveryDay and EveryDay Preferred are both MR points card

AMEX Premier Gold or EveryDay. Which card is better?

They are both good cards, with the latter to be kept without hassle because of no annual fee. I recommend the following card application sequence.

- On N month, you apply for AMEX Premier Gold card 50,000 bonus Membership Reward point bonus, after $1000 spend in 3 months.

- On (N+1) month, your spouse applies for AMEX Premier Gold card 50,000 bonus Membership Reward point bonus, after $1000 spend in 3 months.

- If $195 fee is not for you, then on the N+10 month, you apply for AMEX EveryDay card with 10,000 sign-up bonus after $1000 spend. After receive and activate the EveryDay card, call AMEX support to ask for Premier Gold card retention. If retention amount is not sufficient, cancel AMEX Premier Gold card. Your EveryDay card will keep the AMEX Membership points active.

- On the N+11 month, inside your AMEX account, refer EveryDay to your spouse via email. Have your spouse to apply AMEX Everyday card via your email referral link, so you will earn 5,000 Membership Reward points. Also add you as an authorized (NOT joint) card user of your spouse new AMEX Everyday card. This is the safest way to ensure both of you will receive 10,000 bonus points each, and be able to transfer all your spouse AMEX Membership Reward points to your frequent flyer account, and without drawing extra credit report pull because the authorized card request is processed at the same time for the new card application.

American Express allows card member to transfer the account Membership Reward points ONLY to an authorized AMEX card user's frequent flyer program. Without this authorized card relationship, two persons can transfer their own Membership Reward points only to their own separate frequent flyer accounts. One possible outcome is that each account may not have enough miles to redeem even a coach class air-fare which typically requires at least 70K miles, 20K miles more than the 50,000 bonus points promotion.

By transferring Isa's 80K Membership Reward points into my Singapore Airlines KrisFlyer account, I am able to accumulate 140K KrisFlyer miles as a start. We am planning to fly via Singapore Airlines Business or First to either Europe or Asia in late 2016/early 2017.

How to meet minimum spending

Simply recall typical ways of meeting minimum spend.

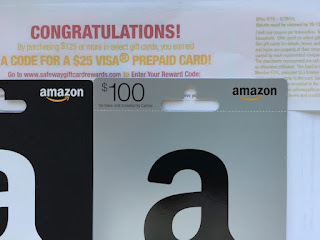

Look out for promotions. Sometimes there are gift card promotions from large grocery chain store such as Safeway. For example, Safeway has a promotion that expires on 9/29/2015, that purchasing at least $125 of selected gift cards will be rewarded $25 Visa gift card, equivalent to a 20% discount. Among the selected participating gift cards, only Amazon appeals to our interests.

Look out for promotions. Sometimes there are gift card promotions from large grocery chain store such as Safeway. For example, Safeway has a promotion that expires on 9/29/2015, that purchasing at least $125 of selected gift cards will be rewarded $25 Visa gift card, equivalent to a 20% discount. Among the selected participating gift cards, only Amazon appeals to our interests.

I also purchased a $500 MasterCard debit gift card with a $5.95 surcharge fee, to meet the $1000 spend in 3 months requirement. After this purchase ($630.95), I am more than half-way done easily. AMEX Everyday rewards 2X for each dollar spent in a grocery store. So there will be 1,261.90 MR points from this transaction in return. It has also been known that a standalone Visa/MC/AMEX debit gift card purchase will not qualify for 2X points reward. Make sure you add some real grocery items WITH the debit gift card purchase.

No comments:

Post a Comment